This is the second in my series analyzing data centirc markets. Read part one: Demystifying the Database Market in 2025.

According to Gartner (2024), by 2027, 80% of data and analytics governance initiatives will fail due to a lack of a real or manufactured crisis. This is a pretty loaded statement, because it tells us 20% of initiatives know what they are doing, while 80% are far off course but are also working on a sunk cost basis (committed to continuing regardless of results).

Lets reframe this – ⅘ organizations investing millions in governance tools, hiring data stewards, and crafting elaborate policies will have nothing to show for it. Not because governance isn’t important. Not because the tools don’t work, because they are doing it incorrectly.

Data governance on its own is pretty useless, it’s typically an overlay on top of existing data centric business workflows (are any business workflows in 2025 not data centric?), but it has an underestimated value. The market certainly sees the value: data governance is exploding from $4.44 billion in 2024 to a projected $18.07 billion by 2032, an 18.9% compound annual growth rate that outpaces most technology categories.

Here are some impact metrics:

- 84% of digital transformation projects fail, primarily due to poor data quality and governance, according to Electronic IQ: Data Governance Statistics and Facts (2025)

- Data breaches (a security concern with connections into governance) now cost $4.88M per incident according to Alation: 8 Critical Data Governance Challenges and How to Navigate them (2025)

- In 2024 67% of data and analytics professionals don’t have full trust in their organizations data for decision making according to Precisely (2024): 2025 Planning Insights: Data Quality Remains the Top Data Integrity Challenge and Priority

If there was ever a time when data governance moved from “nice programme management project” to “existential necessity,” it’s now. The explosion of self service analytics, Gen-AI implementation initiatives, the tightening regulatory landscape, and the sheer volume of data organizations generate have made data governance a core need of today’s enterprise. Yet there still seems to be no common playbook for success; Organizations are buying tools they don’t fully understand, to solve problems they can’t articulate, for users who don’t use them.

This blog is about trying to cut through the noise. I’ll explore what data governance actually is, why the market is important and growing, why most initiatives fail, what actually works, and who the major players are.

Data Governance Explained

da·ta gov·er·nance | ˈdā-tə ˈɡə-vər-nən(t)s | noun

The framework of people, processes, and technology that ensures an organization’s data is accurate, accessible, secure, and actually useful. Regardless of what any tooling or platform vendor tells you; it’s not a tool that can be bought nor is it a role you hire for. It’s the operating model that determines whether your data is an asset or a liability.

Usage note: Often confused with data security (see below).

Common misconception: “We bought a governance tool, so we’re doing governance now.” See also: governance theater.

Data Governance != Data Security

Security asks: “How do we keep malicious actors out?”

Governance asks: “How do we make sure data is trustworthy and people can actually use it?”

They overlap; you need both; but they’re solving different problems. Security is the lock on the door. Governance is knowing what’s in the room, who should have keys, and what they’re allowed to do once inside.

What governance is accountable for:

- Data Quality: Is it accurate, complete, and consistent?

- Data Cataloging: Can people find what they need?

- Data Lineage: Where did this come from? How was it transformed? What breaks if I change it?

- Data Stewardship: Who owns this? Who fixes it when it’s wrong?

- Access Control: Who can see what? How do we say “yes safely” instead of just “no”?

- Compliance: How do GDPR, CCPA, HIPAA, SOX, and other regulations apply to your business?

This all matters because without governance, you’re looking at the failures we opened with; 67% distrust, 84% project failure rates, and millions in quality costs.

The Economics of Data Dysfunction

My opinion: data governance is not a tech problem, it’s a macro economic one. Which is why simple tools and isolated processes aren’t scalable solutions. The impact shows up in productivity metrics, operational costs, and revenue erosion that compounds across the organization.

Let me prove my argument, starting with the damage:

- Poor data quality costs the average organization $12.9 million annually (Gartner, 2021)

- Poor data quality costs companies 12% of revenue

- Bad data reduces workforce productivity by up to 20%

- Operational costs inflate by up to 30%

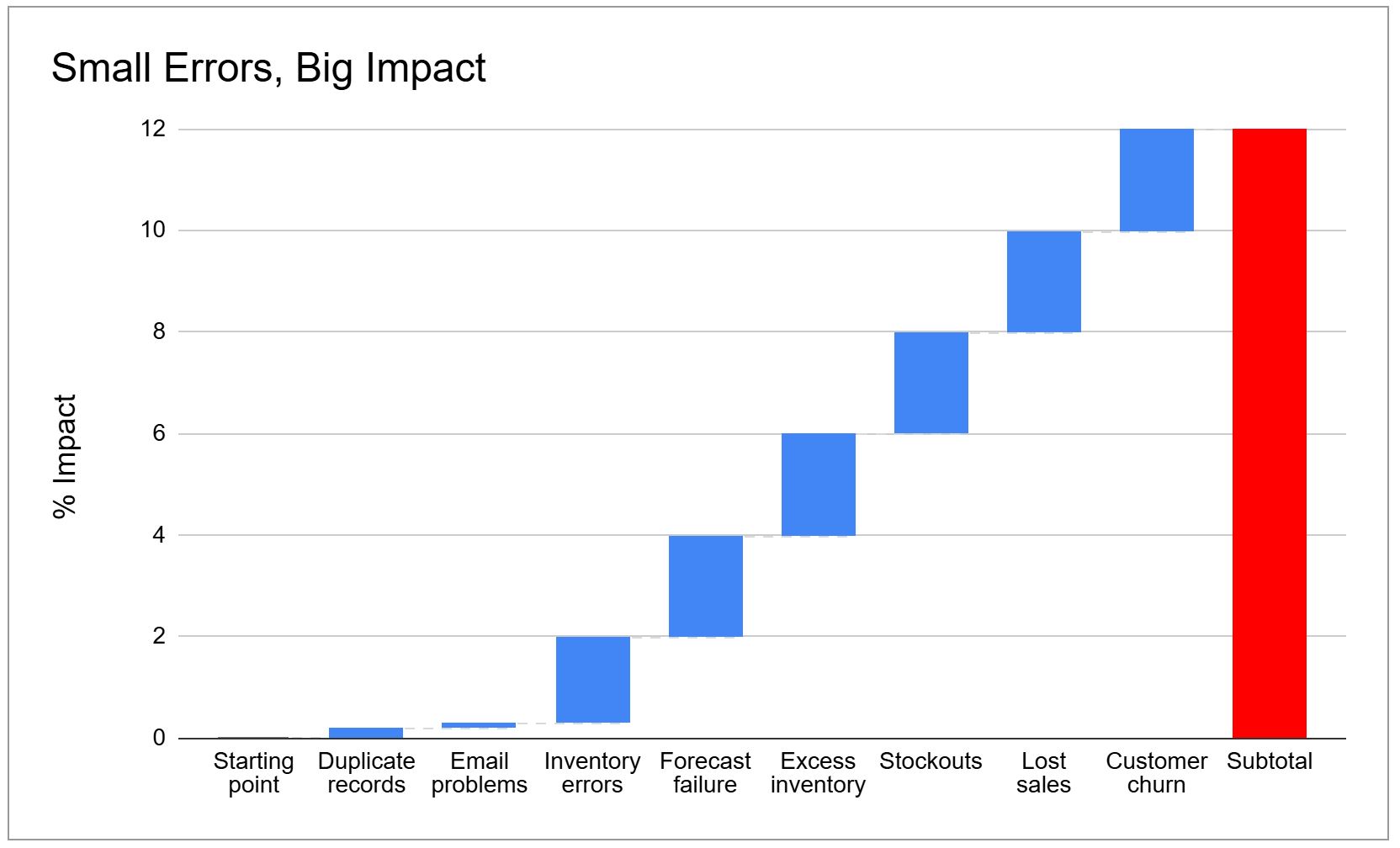

But how does bad data actually cost 12% of revenue? Here’s the butterfly effect:

It starts small. Duplicate customer records mean marketing sends the same email twice. Your inventory system has a 2% error rate. Your demand forecasting model, trained on this bad data, over-predicts demand by 8%. You overproduce, tying up $40M in excess inventory while the SKUs you actually need are out of stock. You lose sales. Customers go to competitors.

Your sales team wastes 30% of their time on bad contact data; wrong numbers, outdated emails, duplicate leads. That compounds: lost deal velocity, missed follow-ups, pipeline that never materializes. Your pricing data shows one price online, another in-store. Customers notice. Trust erodes. Target’s Canadian expansion collapsed partly because bad inventory data led to chronic stockouts; empty shelves, frustrated customers, brand damage.

Each issue might be 0.5-2% of revenue individually. But they cascade. This is the butterfly effect: small errors create feedback loops that amplify until you’re looking at double-digit revenue impact.

In 2025, data governance sits at three critical economic pressure points:

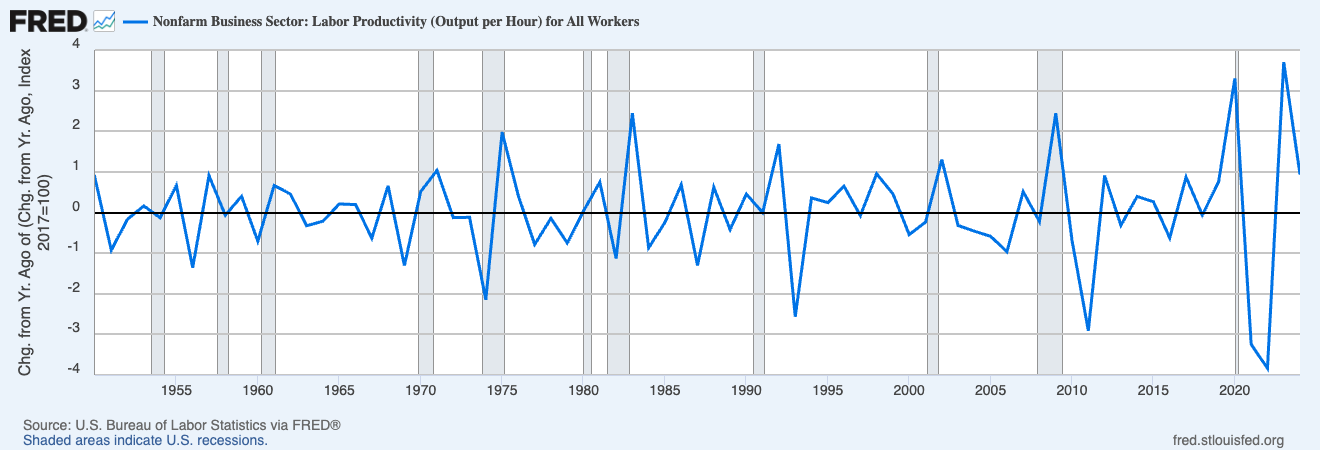

The Productivity Paradox: U.S. productivity growth averaged 3.2% from 1950-1970, dropped to 1.9% from 1970-1990, and has struggled at 1.5% since 2004. That 20% productivity hit from bad data isn’t just fixing errors; it’s the friction of reconciling conflicting definitions, endless meetings to align on “whose numbers are right.”

The Scale Problem: At 50 people, everyone knows where data lives. At 50,000 people across 30 countries with 15 acquisitions, data becomes sludge. Every new system adds exponential complexity. Without governance, growth kills agility.

The Innovation Bottleneck: Clayton Christensen’s “The Innovator’s Dilemma” (1997) showed successful companies fail by optimizing existing business over innovation. Good governance enables teams to experiment quickly with trusted data. Bad governance creates “submit a ticket and wait three weeks” bureaucracy that kills innovation.

The market is growing because governance is the bottleneck to everything: AI, digital transformation, faster decisions. The question isn’t whether you can afford governance; it’s whether you can afford the compounding 12% annual revenue erosion from ignoring it.

What the 20% Actually Do Differently

The vendors will tell you success is about picking the right platform. The data says otherwise. Success hinges on culture, organizational design, and treating governance as a change management problem that technology can amplify but never solve.

Culture Over Technology

Governance success is fundamentally a people problem masquerading as a technology problem.

Evidence: 47% of organizations cite unclear ownership as their biggest blocker to scaling governance. Only 7% cite lack of automation. That means accountable people are about 7 times more important than fancy automation.

What works: Clear ownership where every domain has an owner accountable for quality. Data responsibilities are embedded in job descriptions alongside KPIs, not ad-hoc duties. When Procter & Gamble tackled governance across 48 separate SAP systems, they succeeded because they treated data as a strategic asset with executive support for enterprise-wide MDM.

What fails: A single data governance manager with no support. Governance tasks that are “everyone’s job” quickly become “no one’s job.”

Key lesson: data maturity matters. Organizations with low maturity attempt governance but collapse under unpaid technical and cultural debt. Success requires constantly updating technology and processes to match cultural capabilities.

Photo by Андрей Сизов on Unsplash

Federated Governance

Centralized governance becomes a bureaucratic death spiral at scale. The pattern that appears to work: federated models balancing central oversight with local control.

Evidence: JPMorgan Chase decentralized data ownership to domain teams while maintaining enterprise standards through a federated governance layer. Each business unit manages “data products” in domain lakes; domain owners make risk-based decisions within a governance framework. Result: broke down silos, improved enterprise tracking, enhanced quality control.

Evidence: Capital One’s “sloped governance”, central team builds self-service tools and sets policies, while federated teams execute day-to-day. Different control levels based on data sensitivity. Real-time data access at scale without sacrificing controls.

Key lesson: Strong central standards combined with domain autonomy. Central infrastructure (shared catalogs) so domains aren’t islands.

Data Products and Automation

Organizations that win treat data as a product with users as customers. This fundamentally changes how governance operates.

Evidence: Kiwi.com treated data as discoverable products, consolidating into 58 well-documented data products with context readily available (owners, quality metrics, contracts). Result: 53% reduction in engineering workload, 20% increase in data user satisfaction.

Evidence: Tide used automated scanning for GDPR compliance, accomplishing in 5 hours what would have taken 50 person-days. The automation handled the heavy lifting (finding PII across systems), but humans still set the policies and decided what to do with the findings.

Key lesson: The automation paradox is real. AI is touted for doing governance, but you actually need governance to enable effective AI. Technology handles scale (discovery, classification, monitoring); humans handle strategy (policies, definitions, ethics). Automation augments, it doesn’t replace. Good governance defines trustworthy data products that analytics teams can actually use.

Measuring Success

The 20% who succeed tie governance to tangible business outcomes, not just compliance checkboxes.

Evidence:

- Mature data governance practices = 3× better business outcomes

- Real-time data excellence = 62% higher revenue growth, 97% higher profit margins

- 61% of data leaders say improving data quality and trust is the top success metric

Evidence: Unilever modernized their governance as part of digital transformation, not an IT project. Low-code tools gave business users control. Vendor onboarding time dropped from days to hours.

Key lesson: Start small with specific pain points. Show quick wins. Build momentum. Expand.

Market Dynamics: Where the Money Is Going

Understanding what works is one thing. Navigating the vendor landscape is another.

The data governance market isn’t distributed evenly. Some categories are exploding, others dying, and the gap between what vendors sell and what enterprises actually buy is wider than you’d think.

The Hot Categories

Data catalogs and discovery are the fastest-growing segment. They’re the entry point to governance; you need to know what data you have before you can govern it. Data mesh and data fabric adoption jumped from 13% in 2023 to 18% in 2024, driving catalog demand. Atlan, Alation, and Collibra see strong growth because catalogs deliver visible value quickly.

Data quality and observability is the second wave. 61% of data leaders cite improving data quality and trust as their top governance priority. Monte Carlo, Great Expectations, and Datafold prevent data incidents before they blow up dashboards.

Privacy and compliance automation is driven by regulation, not choice. Average GDPR fines increased 290% from 2020 to 2024. The EU AI Act can impose fines up to $39.82 million or 7% of global turnover. OneTrust and BigID raised massive rounds because regulatory pressure creates genuine urgency.

The Struggling Categories

Master Data Management (MDM) is declining. Modern companies build “good enough” data products quickly rather than pursue 18-month MDM implementations. Legacy players (Informatica, SAP) milk existing customers, but new MDM deals are rare.

Data governance platforms (the “do everything” vendors) struggle. Enterprises adopt best-of-breed approaches, integrating specialized tools rather than betting on single mega-platforms.

Consolidation vs. Fragmentation

The market is consolidating and fragmenting simultaneously.

Supply-side consolidation: Big platforms (Databricks, Snowflake, AWS, Microsoft) bundle governance with infrastructure. Databricks Unity Catalog, AWS Lake Formation, Microsoft Purview threaten standalone vendors.

Recent M&A shows the pressure: Informatica went private ($5.3B, 2021), then public again (2024 IPO). Collibra ($250M Series G, $5.25B valuation, 2021) and Alation ($123M Series E, 2021) raised massive rounds to stay independent.

Demand-side fragmentation: Despite bundling, best-of-breed vendors win because bundled governance is basic. Result: enterprises deploy 5-8 governance tools, not one platform.

The pattern: well-funded startups get acquired by platforms or raise big rounds to stay independent. Middle-tier vendors get squeezed.

Where Enterprises Actually Spend

Note: Specific budget data is proprietary. The following reflects patterns from case studies and vendor disclosures.

Based on observed enterprise implementations:

- Data catalogs and discovery: Highest allocation (Kiwi.com achieved 53% workload reduction)

- Data quality and observability: Strong investment (61% priority per Secoda survey)

- Privacy and compliance: Mandated spending (290% GDPR fine increase)

- Access control and security: Often bundled in broader security budgets

- MDM and legacy: Declining, mostly existing contracts

The Open Source Factor

Tools like Great Expectations, dbt, and Apache Atlas pressure commercial vendors. Enterprises start with open source, then buy commercial support at scale.

Case in point: Fivetran and dbt Labs merged in 2025, uniting data movement with transformation. Open source projects become merger targets, creating new competitive dynamics for traditional governance vendors facing integrated platforms built on open foundations.

What This Means for You

The opportunity: Vendors are desperate to differentiate. Get proof-of-concept periods. Demand integration support. Push for consumption-based pricing.

The risk: Integration tax. Budget for stitching 5-8 tools together, data engineering support, and tool rationalization in 2-3 years.

My research has lead to the following advice:

- Invest in growth categories (catalogs, quality, observability)

- Avoid dying categories (standalone MDM) unless you have specific legacy needs

- Don’t bet everything on one platform; the market hasn’t settled

- Start with 2-3 tools: catalog (find data), quality (trust data), access control (secure data)

- Add more tools only after those three work and you’ve proven ROI

A Note on Market Reality

The $18B governance market isn’t just software licenses. A significant portion is professional services: implementation, integration, training, and ongoing support. For every dollar spent on a governance platform, organizations often spend two to three more on consultants to make it work.

Vendor categories also overlap significantly. Collibra isn’t just a catalog; it offers data quality, lineage, and governance workflows. Informatica sells MDM but also catalogs and quality tools. Atlan started as a catalog but is expanding into observability and access control. The lines blur because vendors follow the money, and enterprises want fewer vendors to manage.

This overlap is both good and bad. Good: you might get multiple capabilities from one vendor. Bad: you’re still paying for best-of-breed tools because the bundled features are rarely as good as specialists.

The Vendor Landscape: Who Are the Major Players?

The data governance market is a mess. Vendors range from legacy enterprise giants to startups that launched last week, each one claiming they’ve solved data governance.

Data Catalogs & Discovery

Searchable inventories of data assets. They auto-discover databases and tables, surface metadata and lineage, enable search across data sources, and track quality and ownership. Organizations use them to help people find and understand data faster.

- Collibra: Enterprise-grade catalog with strong governance workflows. Popular in regulated industries.

- Alation: Collaborative catalog with social features. Focus on building data culture.

- Atlan: Modern active metadata platform. Growing adoption in data mesh architectures.

Master Data Management (MDM)

Create “golden records” for critical business entities like customers, products, and suppliers. Ensures consistency across systems.

- Informatica: Legacy leader with comprehensive MDM suite. Complex implementation and typically requires significant integration work.

- Profisee: Cloud-native MDM platform. Easier to implement than traditional solutions, better suited for agile organizations.

Data Quality & Observability

Monitor data pipelines and detect issues before they impact business decisions. Track data freshness, completeness, and accuracy at scale.

- Monte Carlo: Data observability platform. Monitors pipelines, detects anomalies, alerts on data incidents.

- Great Expectations: Open-source data quality framework. Popular with data engineers for pipeline validation and testing.

Privacy & Compliance

Automate privacy controls, data classification, and regulatory compliance requirements.

- OneTrust: Privacy management platform handling GDPR, CCPA compliance. Automates data mapping and consent management.

- Immuta: Policy-as-code for data access control. Enables fine-grained, automated permissions in federated environments.

Integrated Platforms

End-to-end governance suites built into data platforms. Convenient if you’re committed to the ecosystem. Not an exhaustive list.

- Microsoft Purview: Unified governance across Microsoft ecosystem (Azure, Office 365, Power BI). Strong integration within Microsoft stack.

- AWS Lake Formation: Data lake governance built into AWS. Handles cataloging and access control for cloud-native architectures.

- Databricks Unity Catalog: Governance layer for Databricks lakehouse platform. Growing adoption alongside lakehouse architectures.

Final thoughts: Most organizations use multiple tools because no single vendor solves everything. The typical pattern: best-of-breed tools for critical needs (catalog, quality, access control) that integrate together.

Advice: Identify the specific problems first, then select tools that fit organizational design and culture.

Key Trends: Where Is This All Going?

Photo by Mathieu Stern on Unsplash

AI Governance

GenAI created a governance mess: how do you govern the models, not just the data? Who trained what model, on what data, for what purpose?

Here’s what everyone’s missing: the maturity and implementation of data governance directly correlates to the success of enterprise AI deployments. Model training needs quality data with clear lineage. You can’t open the data floodgates “because AI” without knowing what’s being exposed, who owns it, and whether it can be used for training. Train a chatbot on unvetted data and you’ll expose PII, bake in bias, or leak proprietary information.

Then there’s the agent problem. Organizations are deploying AI agents that autonomously access data. The governance question shifts from “who can query this table?” to “what can this autonomous thing access and under what conditions?” MCP (Model Context Protocol) servers are emerging as governance-aware intermediaries between agents and data. Agents shouldn’t get blanket access just because they’re “AI.” They need the same controls humans get.

The numbers are backwards: only 17% say governance is foundational to AI success, while 34% say it slows them down. Organizations rushing AI without governance either get models that fail on garbage data or compliance disasters when nobody tracked what data went where.

Governance is expanding beyond data to models, prompts, outputs, and agent behavior. New tools are emerging for model lineage, training data provenance, bias detection, and agent access control. Control frameworks matter as much for AI as they do for traditional analytics.

Federated Governance and Data Mesh

Centralized governance dies at scale. It becomes the bottleneck everyone routes around. The numbers back this up: federated adoption jumped from 13% in 2023 to 18% in 2024.

The shift: domain teams own their data products, central teams provide platforms and guardrails. JPMorgan Chase and Capital One are doing this at a massive scale. It works, but only if you have strong central coordination; otherwise you get fragmentation and chaos.

The trend: more hybrid models. Centralize what must be consistent (standards, platforms, compliance). Decentralize what needs speed (domain decisions, quality checks, access). Stop pretending one size fits all.

Active Metadata and Automation

Static data dictionaries are dead. Nobody maintains them. Active metadata platforms capture lineage automatically, propagate policies in real time, surface insights without human intervention.

Gartner says GenAI will accelerate governance time-to-value by 40% by 2027 through automated cataloging and classification. That’s optimistic but directionally right.

The trend: automation handles grunt work (discovering assets, tagging PII, tracking lineage). Humans focus on strategic decisions (what policies matter, who owns what, how to balance access with control). This is the only way to govern at modern data scale.

Real-Time Governance

Quarterly governance reviews don’t work when your data pipeline runs every 5 minutes. You need governance that operates at the speed of your data.

Policy-as-code. Streaming quality checks. Real-time access controls that enforce decisions in milliseconds. If your governance can’t keep up with data velocity, it’s already obsolete.

Conclusion

Data governance fails 80% of the time, but not because the tools don’t work. It’s a coordination problem masquerading as a technology problem. Who controls what data? Who’s accountable when it’s wrong? How does power over data get distributed across an enterprise? These are organizational economics questions, not procurement decisions.

The market reflects this confusion. $18B flowing into a space where buyers don’t understand what they’re buying, vendors can’t articulate what problem they’re solving, and nobody agrees on what success looks like. Organizations throw millions at catalogs and compliance platforms while ignoring the fundamental questions: Who actually owns this? What behaviors need to change? How do we know if governance is working beyond “we didn’t get fined”?

The 20% who succeed get it. Governance isn’t something you bolt onto existing systems. It’s the operating model that determines whether your data becomes an asset or a liability. They build culture before buying tools. They federate ownership because centralized control becomes a bureaucratic death spiral. They measure success in revenue and efficiency, not policy documents nobody reads.

The market will keep growing because the forces driving demand (AI, regulation, data volume) aren’t going away. But that 80% failure rate won’t budge until organizations stop treating governance like a software purchase and start treating it like the organizational change problem it actually is.

You can’t buy your way out of a coordination problem. Ask the right questions, get the right answers.

If you’ve lived through a governance failure (or success), I want to hear about it. The gap between theory and practice is where the interesting research happens. Find me on LinkedIn.