The Database Management System Market in Plain Language

Your job, unfortunately, depends on a database doing what it’s supposed to: record the firm’s relationship to money in a structured format. If that database went away the world would absolutely collapse. I wish I was kidding, but think about it: if your corporate ERP system goes down, we can look at bank statements to rebuild the corporate ledger to some degree (albeit every audit would subsequently fail), but if the bank’s database suddenly vanished, how would anyone know who gave who what, and who owes who which?

Oh wait… that’s the plot of Mr Robot.

Anyway, the database market is everywhere, yet most people couldn’t explain what it actually is, even if their quarterly bonus depended on it. In high-tech we throw around terms like “modern databases,” “cloud-native architectures,” and “AI-enabled data platforms” without stopping to ask: what market are we even talking about, what’s it worth, and why should anyone care?

Think of this blog post as “Silli’s guide to databases” because I’m not allowed to use the Dummies brand.

Economics Professor Mode: What Is a Market?

Before we dive into the topic, let’s establish some fundamentals. A market, in the socio-economic sense, is simply where buyers and sellers come together to exchange value. Think of ye-old village marketplace, but instead of trading apples for bread, we’re trading money for software solutions that help organizations manage their structured data. (AHA! maybe it’s a management system of some sort!)

The database management system market is fundamentally about solving a universal business problem: how do you store, organize, retrieve, and protect the information that keeps your company (and the wider economy) running? Every transaction, every customer record, every inventory count lives somewhere. That “somewhere” is what we’re talking about.

This market has been around since the early days of computing, when databases were essentially sophisticated filing systems for storing the output of those room-sized “super big calculators.” What started as a way to organize punch card data has evolved into one of the most essential and enduring technology markets. This longevity tells us something important: the database market is fundamentally mature, but it’s also not going anywhere. It’s as essential to modern business as electricity or telecommunications.

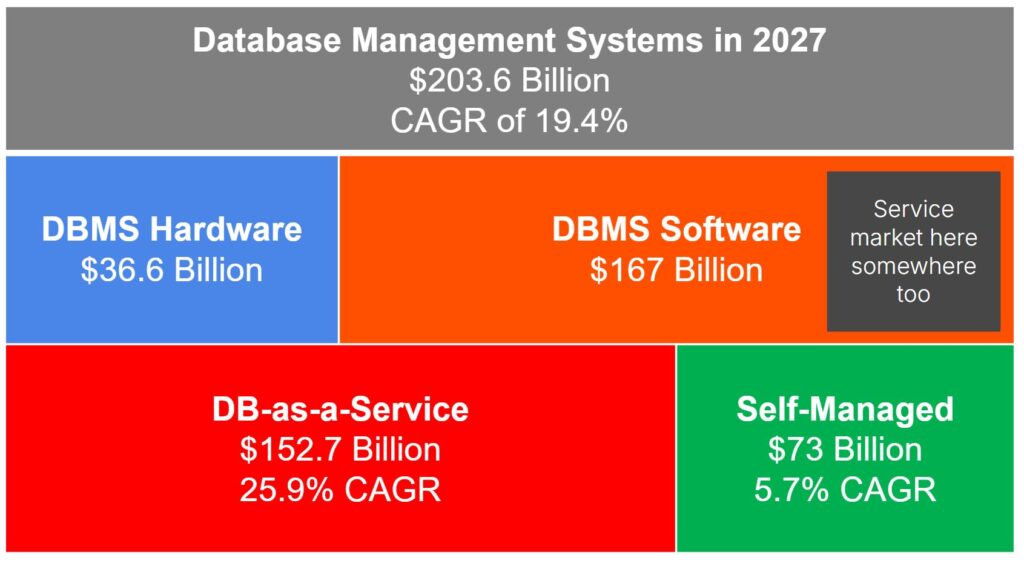

Here’s what we’re actually talking about: a $119.7 billion market in 2024 that Gartner forecasts will reach $137 billion by 2025 , with a 16.8% compound annual growth rate trajectory toward $203.6 billion by 2027. That’s sustained double-digit growth for an industry most people think is “boring software.”

Side note: When doing my BSc, I did a lot of thinking about what my future career would be – at the time I was firmly set that I would not be a DBA or work with databases! The Last laugh is on me there.

But here’s what’s actually driving that growth, and it’s not just digital transformation buzzwords. The OLTP workload portion of the database market is fundamentally tied to economic activity itself. You get more orders, the database needs to do more, companies pay more license money to use bigger hardware, and around it goes. This economic connection explains a significant chunk of that 16.8% CAGR, but it’s not the whole story.

We’re also seeing growth from entirely new workload types that didn’t exist a decade ago: real-time analytics, AI/ML model training, vector similarity searches, streaming data processing. Plus regulatory requirements keep expanding (hello GDPR, SOX compliance, data residency laws), forcing organizations to invest in more sophisticated architectures whether their transaction volumes grow or not.

The Anatomy of the Database Market

No market is one monolithic thing, and the database market is no exception. Instead it’s three distinct but interconnected components:

Database Hardware: Purpose-built computing systems engineered specifically for database workloads. Think Oracle Exadata machines with their specialized storage servers and InfiniBand networking, or IBM’s Z-series mainframes optimized for DB2. These aren’t generic servers, they’re engineered appliances designed to maximize database performance through custom components, optimized I/O paths, and integrated software and support stacks.

Database Software: The actual systems that organize and control access to structured data. This includes everything from Oracle’s enterprise database offerings to PostgreSQL’s open-source solutions. Here’s where market measurement gets tricky: while PostgreSQL itself is free, the ecosystem around it generates real revenue through support contracts, managed hosting, and enterprise tooling. The $119.7 billion market figure captures the direct licensing and subscription revenue, but misses the broader economic activity that open-source databases enable.

Database-as-a-Service (DBaaS): The cloud-delivered, subscription-based database solutions that have transformed how organizations think about data infrastructure. This segment has become the primary growth driver, accounting for 98% of overall DBMS market growth, with cloud platforms now commanding 64% of total DBMS spending versus just 36% for on-premises solutions. This is where the “hot part” of the market is going.

Introducing DBaaS: It’s Not Just About Eliminating DBAs

Database-as-a-service offerings are possibly the most interesting thing to have happened at scale to this market since its inception, and that’s a long time. Yes, they emerged partly because of a fundamental shift in how businesses want to allocate human capital (combined with an enterprise architect’s favorite solution: subscription services!), but that’s not the whole story.

Traditional database deployments (on-premises, license-based, self-managed) required armies of database administrators (DBAs), infrastructure specialists, and maintenance teams. These are smart, expensive people spending their time on operational tasks rather than extracting business value from data. But organizations also adopted DBaaS for technical reasons they couldn’t easily replicate in-house: global distribution, automatic failover, elastic scaling, point-in-time recovery, and security features that would take years to build and maintain internally.

DBaaS flipped the operational model by automating the administrative overhead and wrapping it in a consumption-based pricing model, but it also solved engineering problems that many organizations simply couldn’t solve themselves at scale.

The numbers tell the story. Cloud platforms now command 64% of total DBMS spending versus just 36% for on-premises solutions, representing a fundamental market transformation. Companies realized they’d rather pay AWS or Azure to handle database operational tasks such as patching, backup, and scaling so their teams can focus on building products and gathering insights.

An interesting way to think about a DBaaS is that it’s automation on steroids (everything operational is automated), and the customer only consumes from the connector interface (SQL interface).

Personas: We Miss DBAs, But Love Our Optimized Stakeholder Matrix!

The market used to be simpler. You had a platform admin, a DBA, and the app owner. The DBA made the technical decisions to meet the app owner’s needs, the platform admin (sysadmin) existed to meet the needs of the DBA, on and on it went. Until now, where database purchasing and implementation involves a complex web of stakeholders:

- Cloud Architects who care about integration and scalability

- DevOps Engineers who prioritize automation and deployment velocity (Database Reliability Engineers fall into this persona category)

- Data Engineers focused on pipeline performance and reliability

- Finance Teams evaluating total cost of ownership across hybrid deployments

- Compliance Officers ensuring data governance and regulatory requirements are met

But here’s what’s really interesting: the traditional Database Administrator role is evolving into something completely different. Instead of being server operators, DBAs are becoming data architects, reliability engineers, and cost optimization specialists. The operational tasks that used to define the role are increasingly automated away by the platforms themselves.

This persona proliferation has fundamentally changed how database vendors go to market. You can’t just demonstrate technical superiority to the DBA anymore. You need to speak to cost management, operational efficiency, business agility, and strategic alignment.

The “Modern Database” Is a Myth

I want to address an elephant in the room: the term “modern database” is marketing nonsense.

I couldn’t find a an image for “come at me bro” so just picture my smiling mug

Every database vendor claims to be “modern.” What they really mean is “not the thing you’re currently using.” It’s become a catch-all term for databases that support a combination of:

- Cloud-native deployment models

- Horizontal scaling capabilities

- Developer-friendly APIs

- Support for different data models (document, graph, key-value, etc.)

- Support for new data types (AI!) such as vector embeddings

But here’s the thing: PostgreSQL, which first appeared in 1986, powers some of the most “modern” applications on the planet. Oracle, despite being the poster child for “legacy” databases, continues to evolve with autonomous capabilities and cloud-native features. SQL Server 2025, when it’s released, will be the first on-premises database with consistent enterprise support to unify operational business databases and vector embeddings for RAG-style use cases.

The real question should not be if a database is modern, but whether it solves the use case cost-effectively. Going back to the first paragraph: we do not want to over-disrupt this market.

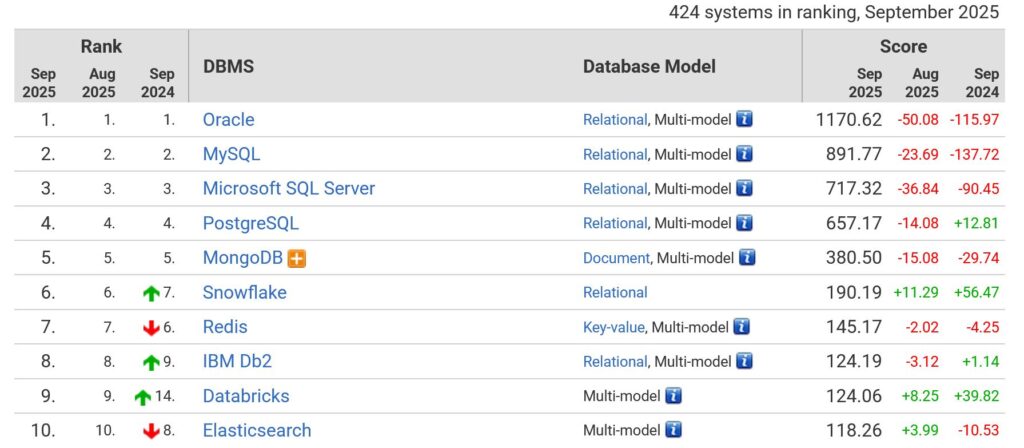

When people ask about database market share, they usually get pointed to DB-Engines rankings. But these rankings measure popularity and discussion volume, not revenue or actual usage.

Here’s how DB-Engines actually works: they aggregate search engine queries, job postings, professional profiles, and social media mentions to create popularity scores. It’s a useful proxy for developer mindshare, but it doesn’t tell you who’s making money or which databases are actually running production workloads at scale.

This creates a fascinating disconnect. Oracle consistently dominates revenue share in enterprise markets while PostgreSQL tops many popularity rankings. But here’s the thing: those $119.7 billion market figures don’t capture PostgreSQL deployments at all because there’s no direct license revenue attributed to the open-source software itself. When Netflix runs PostgreSQL clusters serving millions of users, that shows up in DB-Engines popularity but contributes zero dollars to the “database market” as measured by analysts.

Side Note: WOW MySQL has fallen in popularity – the database wars have truly become spicy.

However, the measurement problem is more complex than just “free = uncounted.” Enterprise PostgreSQL deployments often do generate revenue through support contracts (hello Red Hat, EnterpriseDB), managed services (AWS RDS for PostgreSQL), and complementary tooling. The $119.7 billion captures the direct licensing and subscription revenue, but misses the broader economic ecosystem that open-source databases enable. At the same time, Oracle database has been around since the Cold War; the amount of historical data it’s held makes the footprints it occupies mission-critical and enormous in scale.

The same goes for MySQL, Redis, MongoDB Community Edition, and countless other open-source deployments powering the world’s largest applications. The market measurement problem means we’re systematically undercounting the actual database ecosystem while overcounting the commercial licensing component.

The reality is that different databases thrive in different segments:

- Enterprise Traditional: Oracle, SQL Server, IBM DB2

- Cloud-Native: Amazon Aurora, Google Spanner, Azure Cosmos DB

- Developer-First: PostgreSQL, MongoDB, Redis

The Market Reality: Where We’re Actually Headed

Looking forward, the database market is consolidating around a few key trends:

The Great Convergence: Gartner predicts that by 2027, relational databases will feature 80% of the practical functionality of their NoSQL counterparts (who remembers the NoSQL Craze of 2014-2018?). While RDBMS will hold 73.6% of market share, nonrelational DBMS achieved 22.7% growth in 2024 , with graph databases leading all categories at 26.4% five-year CAGR as specialized use cases demand purpose-built solutions.

Side note: I think the main disruption of the database market is demand for new use cases such as real time pipelines, not new database vendors.

– Multi-Cloud Becomes Table Stakes: Organizations want database solutions that work consistently across AWS, Azure, and Google Cloud without vendor lock-in.

– Operational Automation: The DBA role isn’t disappearing, but it’s evolving toward strategic data architecture and cost optimization rather than routine maintenance.

– Total Cost of Ownership Focus: As cloud costs become more visible, organizations are getting smarter about right-sizing their database deployments and optimizing for actual usage patterns.

By This Point You Should Be Somewhat… Demystified

The database market isn’t really all about databases anymore It’s about how organizations balance the need for reliable data management with the desire to focus human resources on value-creating activities.

Understanding this market means understanding the tension between technical requirements and business priorities. The vendors who succeed are the ones who solve not just the technical problem of data storage and retrieval, but the organizational problem of resource allocation and operational complexity.

That’s what makes this market fascinating. It sits at the intersection of technology and business strategy.

Let’s revisit this in 2026. Maybe we will have completely eliminated databases by then!